Building wealth is not a matter of luck or occasional investing. It is a well-planned process that combines discipline, professional guidance, and the right financial tools. Working with a reliable financial planner helps investors move beyond guesswork and create a structured approach to money management. From planning goals to protecting assets, using the right financial services can significantly improve long-term financial outcomes.

Financial Planning Services That Create Direction

Clarity is the initial step towards creating wealth. A professional financial advisor will assist investors in finding straightforward and long-term goals, including home purchasing, investing in education, retirement, or creating passive income.

Key benefits of personal financial planning include:

- Clear goal prioritization.

- Better cash flow management.

- Attainable investment plans.

- Reduced financial stress.

A certified financial planner makes sure that all the financial decisions are made to support these goals as opposed to working against them. This foundation holds back the investments and impulsive decisions.

Investment Planning for Consistent Wealth Growth

Investment planning is where wealth actually begins to grow. An investment planner structure a portfolio that is designed according to the risk appetite, time horizon and financial goals. Balance and sustainability are emphasized, rather than focusing on returns.

A structured investment plan typically includes:

- Equity for long-term growth.

- Debt for stability.

- Diversified mutual funds.

- Periodic rebalancing.

A financial advisor near mereviews your portfolio to make sure that investments remain up to date with changes in life and market fluctuations.

Mutual Fund Advisory Services for Smarter Choices

Mutual funds offer accessibility and diversification, but selecting the right funds is critical. A professional mutual fund advisor examines variables like fund performance, fund expense ratio, consistency and risk measures before recommending schemes.

Mutual fund advisory services help investors:

- Select between lump-sum investments and SIPs.

- Avoid poor-performing funds.

- Continue diversification by category.

- Remain tactical in the volatile market.

This advice eliminates emotional investing and enhances long-term results.

Tax Planning Services That Protect Returns

Tax planning is a factor that is commonly ignored, but it has a direct effect on the wealth accumulation. A competent tax planner assists in designing investments in the most efficient way to minimize tax liability without violating the law.

Effective tax planning covers:

- Capital gains management

- Saving-tax Investment plans

- Timing of withdrawals and switches

- Optimization of post-tax returns

Hiring a qualified income tax consultant near me means that investors would retain a larger portion of what they receive to enable wealth to compound effectively.

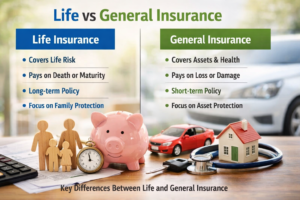

Insurance and Risk Management Services

Wealth creation without protection is incomplete. Insurance planning protects financial objectives against monetary surprises. An informed investment consultant analyzes the insurance requirements to ensure adequate coverage without over-insuring.

Risk management services typically include:

- Income protecting life insurance.

- Health insurance with medical security.

- Property and valuables asset insurance.

An appropriate coverage will not derail long-term investment plans through emergencies.

Retirement Planning for Long-Term Security

Fnancial retirement planning is not only about saving money but establishing sustainable income. To be able to live independently in retirement, a professional financial planner analyzes the cost of retirement, the inflation effect, and the required corpus.

Key aspects of retirement planning include:

- Timely and disciplined investment.

- Reducing risks with age.

- Retirement income planning.

Doing it systematically guarantees a good life and financial freedom in old age.

Regular Reviews and Ongoing Advisory Support

Markets change, goals evolve, and financial strategies must adapt. Frequent meetings with a financial advisor keep investors on track and make the necessary adaptations in time. The ongoing advisory services help to avoid the tendency to make hasty choices in unstable market cycles and strengthen the practice of disciplined investing.

Behavioural Coaching and Investor Discipline Support

Behavioural coaching is one of the most underestimated financial services. The emotional decision-making by investors is usually influenced by market volatility, news cycles and influence by peers. A qualified financial planner is capable of offering behavioural advice on how to stay strategy-oriented instead of focusing on short-term noise.

Investors are assisted by the behavioural advisory support:

- Do not panic sell when there is a correction in the market.

- Remain active on long-term investment strategies.

- Avoid overconfidence in bull markets.

- Be rational in goal-oriented decisions.

The service is a high value offering in the sense that it shields investors against losses that they inflicted on themselves which in most cases is the greatest risk in wealth building.

Conclusion

The appropriate application of financial services transform investing from a guessing game into a strategic move. Financial planning and investment management, tax optimization and risk protection are all services necessary to creating and maintaining wealth. Professional advice from an investment planner will ensure that investors are in a better position to attain financial stability and success in the long term.

For expert financial planning and investment guidance tailored to your goals, connect with Finvriddhi and take a structured step toward long-term wealth creation.