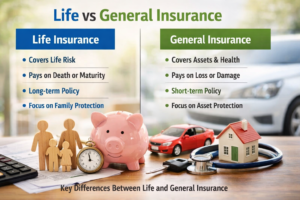

When people hear the term life insurance, most of them think, “That’s only useful if something bad happens.” Some see it as an expense. Others feel it’s something they can think about later in life.

But the truth is — life insurance is much more than just a backup plan.

When chosen correctly and at the right time, life insurance can become an important part of your financial journey. It offers protection, discipline, and long-term security. And with the right guidance from a financial advisor, it can even support your investment and wealth-building goals.

It Protects Your Family’s Financial Future

The biggest reason people buy life insurance is protection — and for good reason.

If something unexpected happens to you, your family should not have to struggle financially. Life insurance ensures that your loved ones have the money they need to:

- Manage daily expenses

- Pay off loans

- Fund children’s education

- Maintain their lifestyle

This financial safety net brings peace of mind. A financial advisor will often tell you that life insurance is the foundation of any solid financial plan because it protects what matters most — your family.

It Helps You Save Money Consistently

Many people struggle with saving money regularly. Expenses, lifestyle habits, and emergencies often get in the way.

Life insurance helps solve this problem.

When you commit to paying premiums, you automatically develop a habit of saving. Certain policies also allow your money to grow over time, helping you build a financial cushion without even realizing it.

This disciplined approach to saving is one of the underrated benefits of life insurance.

It Supports Long-Term Financial Goals

Life insurance isn’t only about death benefits. Some policies are designed to help you achieve long-term goals like:

- Buying a home

- Funding children’s education

- Planning retirement

- Creating a financial backup

With proper planning, life insurance can act as a steady financial tool that supports your goals while keeping you protected.

A good financial advisor can help you choose a plan that aligns with your life stage and future plans.

It Can Help With Retirement Planning

Retirement may feel far away, but the earlier you plan for it, the easier it becomes.

Certain life insurance plans provide:

- Lump sum payouts at maturity

- Regular income after retirement

- Long-term financial security

When combined with other investments, life insurance can help you maintain a stable lifestyle even after you stop working.

This is why many people include life insurance as part of their retirement strategy.

It Offers Tax Benefits

One of the biggest advantages of life insurance is its tax-saving potential.

Depending on the policy:

- Premiums paid may be tax-deductible

- Maturity benefits may be tax-free

- Death benefits are usually tax-exempt

This makes life insurance a tax-efficient financial tool. A knowledgeable financial advisor can help you choose a plan that offers both protection and tax advantages.

It Brings Financial Peace of Mind

Life is unpredictable. Accidents, illnesses, and unexpected expenses can arise at any time.

Life insurance gives you peace of mind knowing that:

- Your family is financially secure

- Your responsibilities are covered

- Your long-term goals won’t collapse

This emotional security is something no other investment can provide.

When you know your loved ones are protected, you can focus better on your career, health, and future.

It Offers Flexibility Based on Your Needs

Life insurance today is not one-size-fits-all.

You can choose a plan based on:

- Your income

- Your age

- Your financial responsibilities

- Your risk appetite

You can also add riders like:

- Critical illness cover

- Accidental death benefit

- Disability cover

- A financial advisor can help customize a policy that fits your lifestyle and financial goals perfectly.

Who Should Consider Life Insurance?

Life insurance is suitable for:

- Working professionals

- Married individuals

- Parents

- Business owners

- Anyone with financial dependents

Even young earners benefit from buying life insurance early because premiums are lower and coverage is higher.

Is Life Insurance Really a Smart Investment?

Yes.

Life insurance should not replace high-return investments like mutual funds or stocks. Instead, it should work alongside them as a protective and stabilizing tool.

Think of life insurance as:

- A safety net

- A long-term support system

- A financial backup plan

- A way to protect your loved ones

When combined with smart financial planning, it becomes a powerful asset.

Final Thoughts

Life insurance isn’t just about planning for death — it’s about planning for life.

It helps you protect your family, build financial discipline, save taxes, and prepare for the future. With guidance from a trusted financial advisor, you can choose the right policy and make it work in your favor.

The best time to buy life insurance is not “someday.” It’s when you are healthy, earning, and thinking about your future.

Because in the end, a smart investment isn’t just about returns — it’s about peace of mind and security for the people you love.