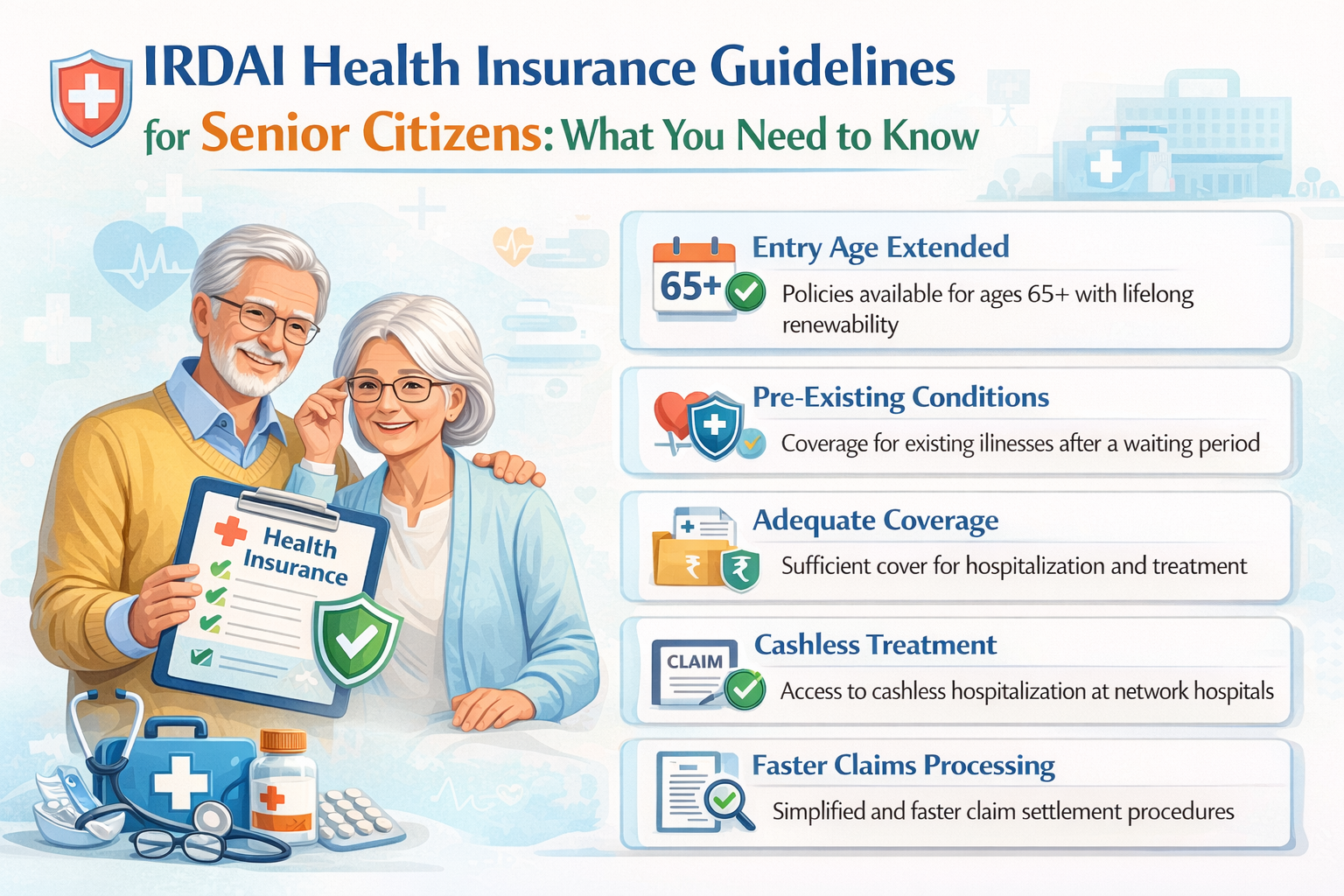

Financial security is in place, particularly among the senior citizens who experience increased healthcare demand and increased cost of healthcare. The recent modifications in the Insurance Regulatory and Development Authority of India (IRDAI) are to make health insurance more affordable, reasonable, and foreseeable to older persons with the policies. These principles are aimed at defending the elderly population and enhancing the general healthcare environment.

This blog clarifies the major IRDAI rules relevant to old citizens in simple language. Additionally, we have mentioned the importance of using professional counseling of a qualified financial advisor in the selection of the correct policy.

How IRDAI Defines Health Insurance Access for Seniors

Age eligibility for health insurance is one of the changes that can be considered the most significant. Earlier, health policies were often restricted to individuals under 65 years of age by several insurers. The IRDAI’s requirement for insurers not to set a maximum age limit on the purchase of health insurance took effect on April 1, 2024. This means:

- Individuals of any age can now apply for health insurance.

- Insurers must design products catering to all age groups, including senior citizens.

- This guideline ensures that older adults are not shut out of coverage options simply due to their age.

A mutual fund investment planner often emphasises this change because it removes a long-standing barrier for older adults seeking medical protection.

Lifelong Renewability and Continuous Coverage

According to the regulations of IRDAI, after issuing a health insurance policy, it must be renewed for life as long as the premium payments are made on time. This means:

- Insurers cannot deny renewal based on age.

- The health policy of a senior citizen must continue without breaks.

A certified financial planner also advises seniors to ensure continuity of cover since gaps in renewal may result in loss of benefit and restart waiting periods.

Waiting Period for Pre-Existing Conditions

One of the major concerns for many senior policyholders is the treatment of pre-existing diseases (PEDs), e.g. diabetes, high blood pressure or heart conditions. IRDAI refers to a pre-existing ailment or any illness that has been diagnosed or for which treatment has been afforded during the 36 months before the inception of the policy.

Under new rules:

- There is a limit to the maximum waiting period that is allowed on pre-existing disease cover of 36 months (three years).

- Once this coverage had been sustained, then the insurers had to cover such conditions, provided that there was no fraud.

- The reduced waiting process renders the health insurance more viable and useful to the older clients.

This updated rule simplifies the process by which older citizens who have underlying health problems can have meaningful coverage at an earlier age.

Specific Waiting Period for Disease and Treatments

In addition to the pre-existing diseases, there is also a specific waiting period for some conditions within a policy (such as cataract surgery, hernia, etc.). The IRDAI guidelines provide a maximum of 36 months in such cases, as long as the policy is renewed continuously.

This standardization helps senior citizens by limiting excessive exclusion periods that previously delayed coverage for common treatments.

Moratorium Period and Claim Protection

Another important IRDAI regulation affects claim disputes and contestability:

- Once the insured has been covered for 60 months (5 years), the insurer cannot object to claims based on non-disclosure or misrepresentation without being proved to have committed fraud.

- This will minimize claim uncertainty and give long-term policyholders a sense of peace, knowing that they may not be subject to scrutiny over ancient medical records.

A financial advisor often explains this as a protection layer–once you have had continuous coverage with an insurance company and it is long enough, the insurer cannot nullify your claim since they can not find out about your past medical history.

Premium Hike Limits for Senior Citizen Policies

Senior citizens historically face higher health insurance premiums due to increased health risks. To protect them from abrupt and steep premium inflation, IRDAI has imposed a guideline:

- Insurers cannot increase senior citizen health insurance premiums by more than 10% per year without prior consultation with IRDAI.

- If an insurer proposes a hike greater than 10% or plans to withdraw a senior policy product entirely, it must consult IRDAI first.

This rule brings predictability to premium costs for older policyholders and prevents sudden pricing shocks.

Conclusion

The recent IRDAI health insurance policies regarding the senior citizens are indicative of a shift to inclusivity, fairness, and long-term cover. The major reforms that include elimination of age limits, minimization of waiting time, constraints to hike premiums and protection against claim contests include making health insurance in India more affordable and dependable to the senior population.

These rules and appropriate policies may be tricky to learn among senior citizens and their respective families. Consult a certified financial advisor to get the best health insurance cover that suits the needs of health and financial objectives.

For personalized health insurance planning and advice that aligns with your long-term financial security, connect with Finvriddhi and get expert support tailored to your needs.