Financial planning is not just about saving money, investing wisely, or planning for retirement. One of the most overlooked but essential parts of a strong financial strategy is insurance. Insurance acts as a financial safety net, protecting you and your family from unexpected risks that can disrupt your long-term goals. Whether it’s health issues, accidents, life uncertainties, or property damage, the right insurance ensures you stay financially stable no matter what life brings.

In this blog, we’ll break down why insurance is important in financial planning and how different insurance types protect your wealth, income, and future.

Why Insurance Is a Key Pillar of Financial Planning

When planning your finances, you usually think about income, investments, savings, and expenses. But what happens if something unexpected occurs—such as a medical emergency, an accident, or job loss? Without insurance, you may have to break your savings, stop your investments, or take loans to cover sudden expenses.

That’s where insurance supports you. It ensures that a crisis doesn’t turn into a financial disaster.

1. Insurance Protects Your Income

Your income is your biggest financial asset. It pays your bills, helps you save, and supports your goals. If something happens to you, your family could struggle financially.

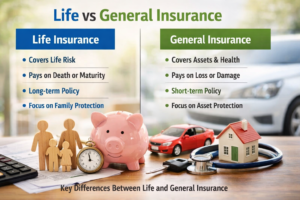

That’s why life insurance and term insurance play a crucial role.

How life insurance fits into income protection:

- It replaces your income in case of an unfortunate event.

- Your family can continue their lifestyle without financial stress.

- Outstanding loans, EMIs, or liabilities can be covered.

Term insurance, in particular, is one of the best tools for safeguarding your family’s future. It provides high coverage at a low premium and ensures financial stability even in emergencies.

2. Health Insurance Protects Your Savings

One medical emergency can drain years of savings. Hospital bills, surgeries, medicines, and aftercare can be extremely expensive. Health insurance ensures these bills do not affect your financial goals.

Why health insurance is essential:

- Covers hospitalization costs

- Offers cashless treatment

- Protects long-term savings from medical expenses

- Covers critical illness and major surgeries

Without health insurance, you may end up using your emergency fund or breaking fixed deposits. With insurance, your savings stay intact.

3. Insurance Supports Long-Term Financial Goals

Your long-term goals—buying a home, children’s education, retirement—depend on consistent savings and investments. Unexpected events can disturb this flow.

How insurance helps:

- Provides stability during uncertainties

- Ensures investments continue without interruptions

- Offers riders like waiver of premium, which keeps your investments active even if you lose income

Some investment-linked insurance plans (ULIPs, endowment plans) also help you save slowly and steadily while giving life cover.

4. Protects Your Assets from Financial Loss

Your home, car, and valuable belongings are assets that need protection. Damage, accidents, or theft can lead to massive repair or replacement costs.

How general insurance helps:

- Car insurance protects from accident repairs, theft, and third-party liabilities.

- Home insurance protects property from fire, theft, natural disasters, etc.

- Travel insurance protects from trip cancellations, medical emergencies abroad, baggage loss, and more.

Protecting your assets ensures that sudden losses do not force you to dip into your long-term savings.

5. Helps Build a Strong Financial Cushion

Every financial plan must include a safety net. Insurance works as a financial cushion that keeps you ready for the unexpected.

This includes:

- Accident insurance

- Critical illness cover

- Disability insurance

- Term life insurance

- Health insurance

These layers of protection ensure that you never have to compromise on your financial goals due to sudden events.

6. Reduces Financial Stress and Brings Peace of Mind

A strong financial plan isn’t just about money—it’s about peace of mind. Knowing that your health, income, assets, and family are protected gives you confidence and stability.

When you have insurance:

- You don’t worry about big medical bills

- Your family is protected even if you’re not around

- Your savings and investments grow uninterrupted

- Your overall financial life stays on track

Stress-free planning leads to better decision-making and better financial outcomes.

Conclusion

Insurance is not just an additional expense—it’s a foundation of smart financial planning. While investments help you build wealth, insurance ensures you never lose it suddenly. It protects your income, savings, health, assets, and future goals from life’s uncertainties.

A well-balanced financial plan should include:

- Life insurance

- Term insurance

- Health insurance

- Motor and home insurance

- Critical illness and accident cover

When you combine good insurance coverage with disciplined investing, you create a secure and successful financial future.