Blogs

Get In Touch

Savings vs. Investments: Which Is Best for Your Financial Goals?

Managing your finances effectively becomes more essential as the world’s financial situation changes rapidly. Many people earn a steady income, but due to a lack of financial literacy, they get confused while making financial decisions. When it comes to personal finance, the most prevalent and important question is whether to

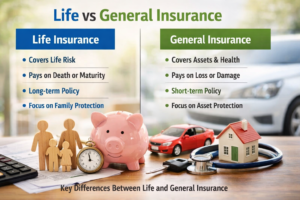

What Are the Key Differences Between Life and General Insurance?

Insurance is one of the main pillars of financial planning, but most people have difficulty knowing the difference between life insurance and general insurance. Although both are used as risk-protection tools, their aims, scopes, terms, and advantages differ greatly. To select the appropriate kind of insurance, you need to make

Top Financial Services Every Investor Should Use to Build Wealth

Building wealth is not a matter of luck or occasional investing. It is a well-planned process that combines discipline, professional guidance, and the right financial tools. Working with a reliable financial planner helps investors move beyond guesswork and create a structured approach to money management. From planning goals to protecting

What Is Expense Ratio? How It Impacts Your Mutual Fund Returns

When investing in mutual funds, investors are concerned with returns, fund performance and also the market trends. Cost is one of the important factors that are usually neglected. Understanding what is expense ratio and how it works is essential because even small costs can significantly affect your long-term returns. The

5 Best Types Of Low Risk Mutual Funds In 2026

Investment does not necessarily mean making high returns at the cost of sleepless nights. For many investors, stability and capital protection are more important, particularly in uncertain markets, rather than aggressive growth. That is where the best low-risk mutual funds 2026 come into focus. These funds are also supposed to

How Much Health Insurance Cover Do You Actually Need in 2025?

Health expenses today aren’t like they used to be back in the day. The hospital bills, treatment costs, and routine check-ups have become more expensive in recent years. With this rise, one thing has become apparent: simply picking any random health insurance plan isn’t enough anymore. It is high time

Life Insurance for Young Professionals – Why It’s Cheaper to Start Early

When you’re in your 20s and 30s, you’re usually immersed in enjoying your newfound independence, building a career, and exploring different opportunities. Amidst all this, insurance rarely makes it to the priority list. Many individuals wonder: Why think about life insurance when you’re young, healthy, and just getting started? Little

Investment Options for NRIs in India – 2025 Guide

Planning your finances as an NRI can feel overwhelming, especially because the investment landscape keeps evolving rapidly. Whether your goal is to build your wealth, create a steady source of secondary income, or want to invest in a booming economy, there are multiple investment options for NRIs in India in

How to Create Your First Budget: 50-30-20 Rule Explained

After months of procrastination, you’ve finally made up your mind to focus on saving money. What if you don’t have a solid plan in mind? Added to this is the stress of whether you will do it correctly. Overwhelming, right? Don’t worry! With the best approach, you can get started.

How Insurance Fits Into Your Financial Planning

Financial planning is not just about saving money, investing wisely, or planning for retirement. One of the most overlooked but essential parts of a strong financial strategy is insurance. Insurance acts as a financial safety net, protecting you and your family from unexpected risks that can disrupt your long-term goals.

What Are Corporate Fixed Deposits? A Beginner’s Guide

When it comes to safe and stable investment options in India, most people immediately think of bank fixed deposits (FDs). But there’s another powerful alternative that offers higher interest rates and flexible payout options—Corporate Fixed Deposits. If you’re a beginner trying to understand what corporate FDs are, how they work,

How to Choose the Right Mutual Fund Investment Planner for Your Financial Goals

Investing in mutual funds has become one of the most popular ways to build long-term wealth in India. However, with hundreds of schemes, categories, and strategies available, beginners often feel confused about where to start. This is where a mutual fund investment planner plays a crucial role. A planner guides