Planning your finances as an NRI can feel overwhelming, especially because the investment landscape keeps evolving rapidly. Whether your goal is to build your wealth, create a steady source of secondary income, or want to invest in a booming economy, there are multiple investment options for NRIs in India in 2025. Depending on your goals, you can build the right investment strategy by choosing among safe, moderate, or high-growth options. From traditional favorites to modern investments, there’s something for everyone in India.

In this guide, we will highlight the best investment options for NRIs in 2025 so that you can make confident decisions.

What are the Best Investment Options for NRIs in 2025?

While there is a wide range of options for NRI investment in India, some of the best ones include:

Fixed Deposits:

NRI fixed deposits are one of the most popular choices for individuals who are looking for safe investment options. These attract steady returns as well, ensuring maximum peace of mind. There are many different kinds of FDs that you can invest in as an NRI, each offering unique benefits. These include:

- NRE FDs (tax-free interest on your foreign income, fully repatriable)

- NRO FDs (taxable interest on income earned in India, repatriation is limited)

- FCNR FDs (ideal for making fixed deposits in foreign currency)

Mutual Funds:

Mutual funds involve pooling money from multiple investors and then investing it in various securities. NRI mutual funds investment can also be done in three different forms:

- Equity Funds (investments in the stock market that offer long-term growth)

- Debt Funds (investments in government and corporate bonds for a stable income)

- Hybrid Funds (a balance between risks and returns through investments in both equity and debt)

Real Estate:

Real estate investment for NRIs living abroad is one of the traditional investment options. This is because the values of properties in the top cities have consistently increased in the past few decades. In fact, real estate investments also become a source of rental income for many NRIs, promising a steady cash flow.

Public Provident Fund or PPF:

PPFs offer tax-free returns to the investors with a lock-in period of 15 years. However, it is important to note that this investment option is only available for NRIs who had opened an account before they became non-residents.

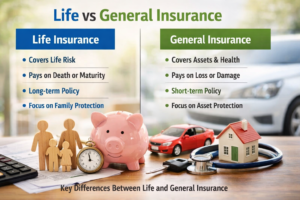

Life Insurance:

Another excellent option for NRI financial planning in India is life insurance. It offers financial security to your family, along with market-linked returns. If you want part of your investment to be a life cover and the rest to go to savings and funds, you should opt for ULIPs.

National Pension System or NPS:

NPS, popularly known as retirement savings, includes a mix of bonds, equity, and government securities. This is the best long-term investment for NRIsbecause it ensures that you spend the phase of your life after retirement peacefully and comfortably.

Direct Equity Investments:

Through the Portfolio Investment Scheme, NRIs can also invest directly in Indian stocks. You will have to use your NRE or NRO accounts for the same. Although equity investments are known to carry market risks, you can earn high returns by investing in the right companies. Some examples include blue-chip companies like Infosys, Reliance, etc.

Gold:

If you are in search of the safest investment options for NRIs in 2025 that protect you against inflation, you must consider investing in Gold ETFs or Sovereign Gold Bonds. These are also good alternatives for those who wish to diversify their portfolio.

What Not to Do: Investment Mistakes NRIs Should Avoid

Here are some mistakes you should avoid during NRI investment in India:

- Not understanding your legal eligibility

- Not investing in the right real estate

- Investing without proper research and analysis

- Ignoring modern investment alternatives

- Falling for unrealistic promises

- Not having an exit strategy

- Not having a properly guided investment portfolio

- Not having a power of attorney

Conclusion

Choosing the right investment options for NRIs in India isn’t difficult, especially with a wide mix of opportunities available in the country. Whether you prefer low-risk options that give steady returns, are looking for high-growth investments, or want long-term wealth-building tools, you will find multiple choices. The key is to understand your goals, know your eligibility, and make informed decisions instead of relying on assumptions or guesswork. By avoiding common mistakes and exploring the right investment options that align with your financial plans, you can build a strong portfolio from anywhere in the world. Just make sure to have the right strategy in place so that you can enjoy stability, growth, and long-term financial comfort as an NRI.

Need guidance on the best investment options for NRIs in 2025? Come to Finvriddhi and get clear answers to all your questions from our seasoned experts!