After months of procrastination, you’ve finally made up your mind to focus on saving money. What if you don’t have a solid plan in mind? Added to this is the stress of whether you will do it correctly. Overwhelming, right? Don’t worry! With the best approach, you can get started. One of the easiest ways to create your first budget is the 50-30-20 rule, a popular budgeting method that helps you divide your income into categories every month. Whether you’re trying to keep your spending in control or want to save more consistently, this personal budgeting rule gives you a clear roadmap.

Want to know how it works? Let us help you understand this so that you can start budgeting with confidence.

What is the 50-30-20 Rule?

The 50-30-20 rule is a simple solution for those wondering how to create a budget. This rule dictates how your monthly income should be divided so that you can save enough money. According to this rule, you should split your income into three categories:

- 50% for needs

- 30% for wants

- 20% for savings

By following this simple approach, you can take control of your monthly budgeting like a pro.

Now comes the most important question: what comes under needs and wants (the expenses part)? Here’s a closer look:

- 50% for Needs

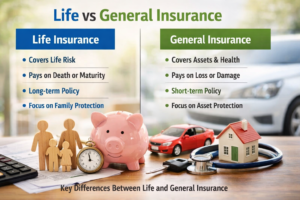

According to the 50-30-20 saving and spending rule, 50% of your monthly income should be reserved for needs. How do you define needs? These are expenses that you must make for survival, including your financial obligations and responsibilities. These include:

- Utility bills

- Groceries

- Healthcare

- Rent or mortgage payments

- Insurance premiums

- Educational fees

- Car payments

- Other debts

- 30% for Wants

Next in line are wants, the things that aren’t absolutely necessary, but you enjoy spending money on them, so you choose to. These involve purchases associated with your lifestyle, entertainment, leisure, etc. Of course, these aren’t the things that you can’t live without; they fuel your enjoyment and interest in life. By following the 50-30-20 budgeting method, you should set aside 30% for your wants. These include:

- Subscriptions

- Restaurant meals

- Luxury items (watches, bags, perfumes, etc.)

- Non-essential electronics

- Supplies for your hobbies

- Tickets for movies, plays, or concerts

- Jewellery and other fashion accessories

- 20% for Savings

Once you have allocated 80% of your earnings to needs and wants, the rest of it goes to your savings. This can also include investments. Make sure to break down your savings into further categories, such as medical treatments, emergency funds, retirement savings, etc. A good tip for budgeting for beginners is that when you plan your savings, think about both your short-term and long-term financial goals. Savings can be done in the following forms:

- Setting aside an emergency fund

- Creating a mutual fund account and contributing to it

- Depositing money into a high-yield savings account

- Buying physical properties for long-term holding

- Investing in stocks, index funds, etc.

The Benefits of Following This Rule of Budgeting for Beginners

Let us now move on to discussing the benefits of the 50-30-20 rule:

- Financial Discipline:

Through simple budgeting strategies like the 50-30-20 rule, you can achieve financial discipline. When you follow this rule for a longer period, you have better control over your money. So, you can steadily collect a good amount to fulfil your dreams.

- Easy to Use:

This rule is the most uncomplicated option for those who keep wondering how to manage money. It is very simple to understand this rule and apply it in real life. No need to maintain fancy spreadsheets or make difficult calculations; just split your income into three parts in the ratio of 5:3:2.

- Expense Prioritization:

When you have a set amount to spend and stick to it diligently, covering your fundamental needs without going over budget becomes easier. You can start by allocating the funds to the most important expenses of the month first, followed by casual spending, while still saving consistently.

- Better Debt Management:

Many people end up spending most of their salary on unnecessary things and regretting it later as the EMI due date nears. These are individuals who don’t know how to divide income. For such people, the simplest solution to manage their debts better is to follow the 50-30-20 rule and set aside funds for debt payments before non-essential spending.

Conclusion

The 50-30-20 rule is proof that monthly budgeting doesn’t have to be complicated or intimidating, even if you are doing it for the first time. It gives you three simple categories to divide your income: needs, wants, and savings. Irrespective of how much you earn, this rule proves to be effective for you, making it possible to cater to your essential requirements, lifestyle needs, and savings. So, if you’re looking for a practical and effective budgeting method, your search ends with this rule. Just remember to be consistent and try to increase your savings percentage as you improve your spending habits.

If you’re looking for the best-suited financial solutions for your future goals, you can seek the help of the experts at Finvriddhi. Call us today!